More On Independent Digital Ecosystems as the Future of Wealth Management

In my last article, Independent Digital Ecosystems Are the Future of Wealth Management, I described the benefits and use cases for a new approach to advisor technology development, one that solves the integration problems preventing firms from scaling their businesses and optimizing their growth opportunities.

The concept of “independent, integrated digital ecosystems” holds great promise for solving this problem and providing advisory firms and financial institutions a new way to better maximize use of today’s cloud-native technologies for designing their own digital experiences, and in effect create their own “app stores” for their businesses.

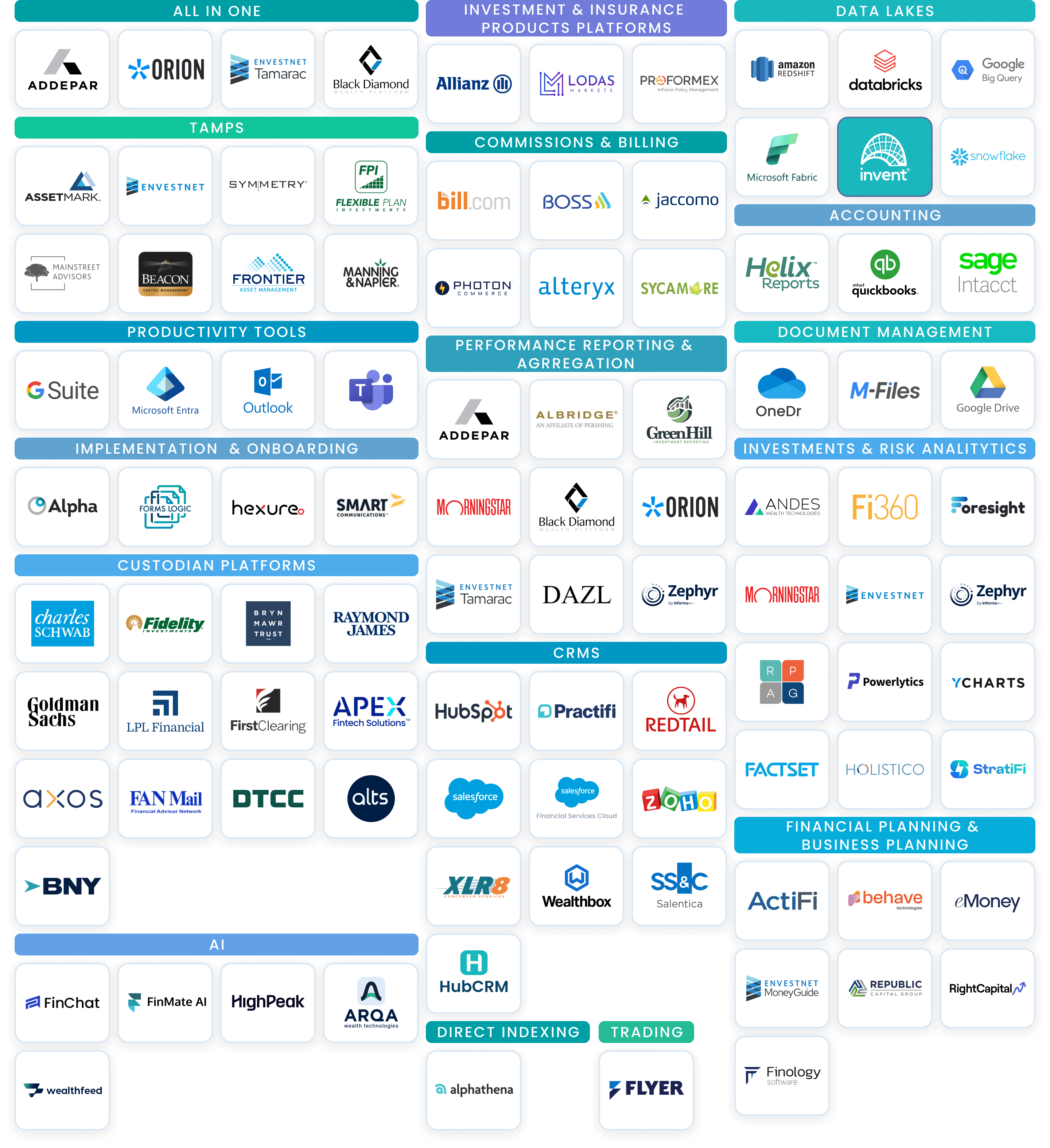

Currently, when advisory firms and financial services companies decide to build a more integrated experience for their financial professionals, their clients, and their home office staff, they are faced with the problem of figuring out how to blend all the apps they use together in a single smooth digital experience on the web and, ideally, mobile phones.

Firms hire developers to build custom portal solutions or integrations using the available APIs from the third-party systems they want to connect. This often requires a lengthy process to roll out and becomes even more challenging to maintain over time. Third-party vendors add new product features and change their APIs over time. Any of those changes require recoding of the business logic that the firm implemented and if the firm integrates more than three or four systems together, this becomes an ongoing effort—just to keep things up and running. Also, any new feature that the business needs to add would require custom development work, which becomes an ongoing activity and cost center going forward.

Larger firms pay vendors to build a custom version of their software tailored to the firm’s needs and that integrates with the firm’s internal systems. This almost always becomes an expensive, lengthy process. In addition, vendors end up with a custom set of code for each of their large enterprise customers, making not only the ongoing maintenance of that code problematic but inhibiting their ability to more quickly upgrade their own core product resulting in a real developer nightmare.

There is a solution to all of the above-mentioned challenges that can be achieved by implementing an integrated digital ecosystem based on open architecture. Just as developers can build apps and publish them on the Apple App Store, Google Play or cloud marketplaces of Amazon AWS or Microsoft Azure, imagine third-party vendors building components or even entire applications that can be “installable” in the digital ecosystem of an independent RIA or broker dealer.

This integrated digital ecosystem approach solves the problem with constantly changing and maintaining custom code and provides third-party vendors the ability to build interactive components of their application such as rebalancing, trading, or portfolio analytics without having to expose all of those capabilities in their public APIs. Now the end user (advisor, client or home office) can simply drag and drop components from various vendors on digital boards similar to how you would build a board on Pinterest.

This all probably sounds good but what exactly are we talking about? What is an integrated digital ecosystem? And how does it work?

Key Characteristics and Components of an Independent Digital Ecosystem

An integrated digital ecosystem is an integration framework and new approach to software development and design that includes multiple wealth technology capabilities. These include a data warehouse or data lake, micro aggregation API services, integration adaptors, micro frontend SDK (software developers kit) UI/UX (user interface/user experience) frameworks, pre-configured application integrations for popular, name brand third-party CRM, financial planning, reporting, risk profiling, trading, client portal, etc., as well as “no code” page builders which bridge the user experience gap across home grown and third-party complementary applications.

Let’s walk through each of these to provide context for how an advisory firm or financial institution can leverage these tool kits to create their own custom applications. Data lakes and warehouses combined with API Micro Services/Adapters accelerate data replication, ingestion, synchronization and streaming so your digital ecosystem has clean, uniform data that can flow easily back and forth between your own and third-party applications, such as CRM, planning and others.

The SDK UI/UX tools speed up co-development of business needs for firms and leading third-party vendors into one digital ecosystem—providing platform extensibility for in-house and third-party development that facilitates similar user experiences across multiple applications. Basically, these tools make a quick and easy job of bringing together your existing technologies with the latest third-party apps your advisors want to use.

From there, integration frameworks power third-party integrations made available via pre-configured integration APIs pre-built and customized to today’s most popular third-party software applications.

Lastly, no-code page builders provide administrators and end-users the power to quickly build personalized web pages via “drag and drop” capabilities. And these pages can display key data insights and analytics for business unit leaders, financial professionals, supervisors, admins and home office personnel so you have business intelligence, transparency into business processes, and key information at a glance. This can enhance advisor productivity, streamlines workflows and ensures client service levels are met at the highest standards.

Ultimately, what these new integrated digital ecosystem development tools bring you is the ability to design your own, unified experience; bringing together all of the latest technologies into one, simple and elegant application that can run your business, scale with growth and finally free up advisors to focus on the things that truly matter: clients and growth.

The good news is that cloud-native platforms have created an integration framework that can provide integrated digital ecosystems “as a service.” Those custom built for wealth management enable advisors and financial institutions to make use of pre-built templates, tools, customized APIs and data capabilities that any advisory firm or financial institution can immediately deploy so you don’t have to hire dozens of programmers, spend months, if not years on a project, and can save literally hundreds of thousands if not millions of dollars.

Just think of how this can transform your business, enabling you to finally have automated workflows, seamless integrations with your various software solutions, TAMPs and custodians, all customized, owned and controlled by you, the business owner.

You will gain the scale and capacity to grow your firm and ultimately digitally transform your business. Particularly as the industry is becoming more complex, competitive, and is consolidating on a daily basis through M&A, which will leave you with fewer and fewer options. Now is the time to finally own your independent technology destiny.

Oleg Tishkevich is CEO and founder of INVENT, a cloud-native technology platform focused on the wealth management industry.