Why INVENT® Data Lakehouse?

In today’s wealth management and banking environment, data is your firm’s most strategic asset — but only if it’s unified, trusted, and actionable.

Most firms struggle with siloed systems, legacy platforms, manual processes, and inconsistent reporting. INVENT® solves this with a modern, purpose-built data platform engineered for the real-world complexities of financial services — from wealth management and fintech to retail and commercial banking.

Artificial intelligence thrives on high-quality, unified, and well-governed data. Without it, AI becomes guesswork. The INVENT® Data Lakehouse provides the trusted foundation your AI needs to deliver accurate, relevant, and actionable insights.

Purpose-Built for Wealth Management & Banking

Unlike generic data solutions, INVENT is designed specifically for the needs of RIAs, broker-dealers, OSJs, multi-custodian platforms, and banking institutions. From AUM tracking to compliance reporting, rep code harmonization to householding logic — INVENT speaks the language of wealth management, while also addressing the unique requirements of banking such as loan portfolio analytics, deposit trend monitoring, risk management, and regulatory reporting.

Key Features

At the heart of INVENT is a next-generation Data Lakehouse, combined with the Data Vault 2.0 methodology. This gives you:

- Scalable, historical, and audit-ready data modeling

- Support for structured, semi-structured, and unstructured data

- Real-time and batch ingestion across custodians, CRMs, and planning tools

- Schema evolution to support changing business rules

INVENT includes built-in MDM to create a single source of truth for core entities like:

- Clients and households

- Financial professionals and rep codes

- Accounts, products, and legal entities

This enables consistent data across CRM, planning, compliance, reporting, and compensation systems —reducing errors, reconciliations, and operational risk.

INVENT enforces strong data governance, privacy, and compliance controls:

- Role-based access control (RBAC) with Microsoft Entra ID, Okta, and OpenFGA

- Full data lineage, change tracking, and audit trails

- SOC 2-aligned controls, encryption, and policy-based access

- Seamless support for KYC, AML, Reg BI, and SEC requirements

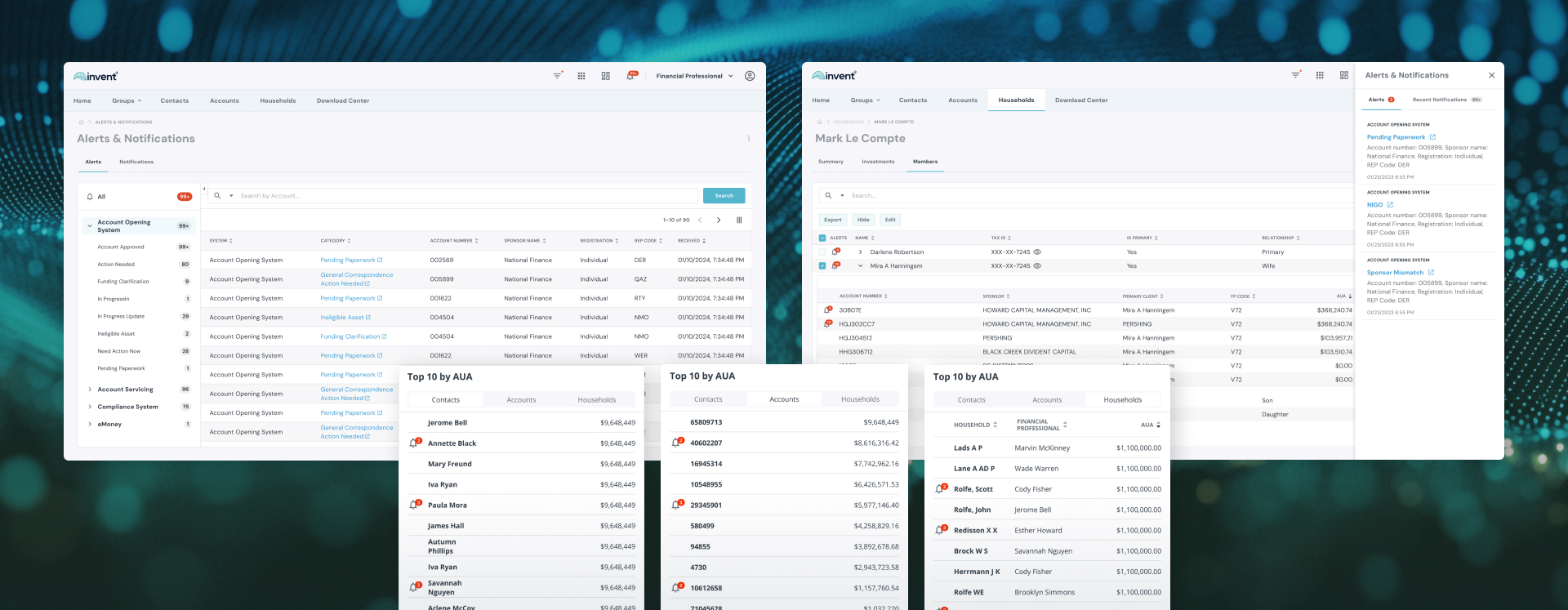

With n8n.io embedded as the native workflow engine, INVENT enables:

- Intelligent alerts and notifications

- Case orchestration (onboarding, ACATs, servicing)

- Trigger-based workflows across data, APIs, and apps

- Custom workflows integrated into portals using Experience Builder

INVENT integrates with Apache Superset for intuitive, no-code data exploration:

- Create dashboards without SQL

- Drill down into clients, accounts, AUM, revenue, and onboarding pipelines

- Role-based dashboards for advisors, executives, compliance, and operations

Through INVENT Experience Builder, firms can:

- Build modular, persona-based portals

- Embed MicroApps with data context

- Personalize user experiences by role, team, or business line

- Support advisor transitions, multi-brand strategies, and field rep hierarchy views

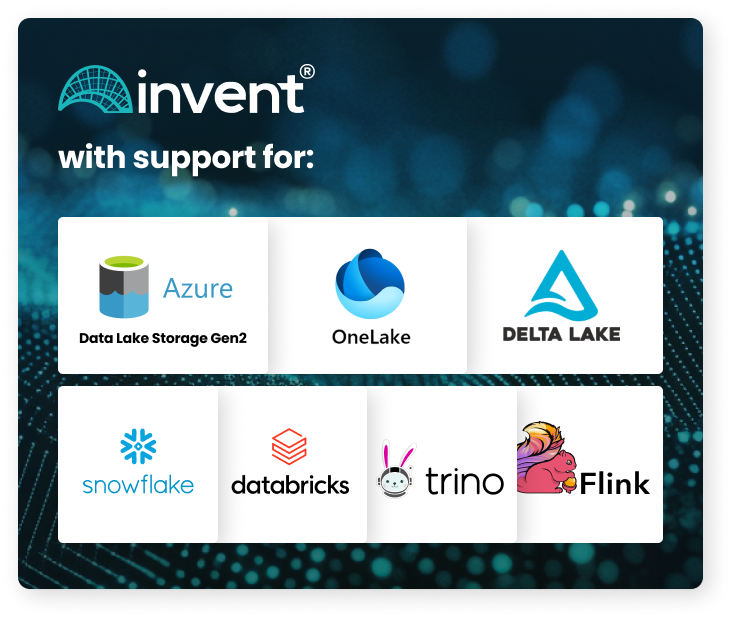

INVENT Data Lakehouse is powered by a modern, open architecture:

- built on Trino for high-performance federated querying

- Apache Spark for large-scale data processing

- Apache Iceberg with a native Iceberg meta catalog for open table formats, schema evolution, and ACID compliance

- Apache Superset for advanced, interactive analytics and visualization.

This foundation delivers scalability, interoperability, and AI-readiness — enabling wealth management, banking, and financial services organizations to integrate, govern, and analyze data from multiple sources in real time, all with the flexibility of an open data architecture and the precision of an enterprise-grade meta catalog.

INVENT seamlessly ingests, harmonizes, and stores structured and unstructured data across:

- Custodians (e.g., Pershing, Schwab, Fidelity)

- CRMs (e.g., Salesforce, Redtail)

- Planning and insurance systems

- Onboarding and policy platforms

Through Data Vault 2.0, INVENT ensures historical traceability, auditability, and flexibility—supporting evolving business models, regulatory needs, and rep code structures.

Our Lakehouse integrates with:

- Snowflake and Databricks via native connectors

- Open APIs and SDKs for pushing or pulling data into CRMs, TAMPs, policy engines, or custom apps

- Azure OneLake and modern Microsoft Fabric environments for extended ecosystem compatibility

Our architecture supports:

- ACID transactions for data reliability

- Schema evolution without breaking pipelines

- Master Data Management (MDM) to standardize clients, households, accounts, and reps across all systems

This creates a true single source of truth, trusted by both business and compliance teams.

Outcomes That Matter

- Accelerate advisor productivity and retention

- Improve data trust and compliance defensibility

- Enable scalable growth through data reuse and automation

onboarding

time by